Pairs trading is one of the most powerful market-neutral strategies used by professional traders. Instead of predicting whether the market will go up or down, traders focus on the relative performance between two correlated assets. With advanced charting tools available on TradingView, implementing pairs trading strategies has become easier and more precise than ever.

In this article, we’ll explore the top TradingView pairs trading strategies every trader should understand and apply.

What Is Pairs Trading?

Pairs trading involves selecting two correlated assets and taking opposite positions when their price relationship deviates from historical norms.

For example:

- Buy the undervalued asset

- Sell the overvalued asset

When the price spread returns to its average, the trader closes both positions for profit.

This strategy reduces overall market risk because gains and losses are based on relative movement rather than overall market direction.

1. Correlation-Based Pairs Strategy

The foundation of any pairs trading strategy is correlation. On TradingView, traders can compare two assets using the “Compare” feature or create spread charts with custom scripts.

How it works:

- Identify two highly correlated assets (e.g., two stocks in the same sector).

- Monitor their historical correlation.

- Enter a trade when divergence exceeds a predefined threshold.

If correlation breaks down completely, it may signal structural change — so risk management is critical.

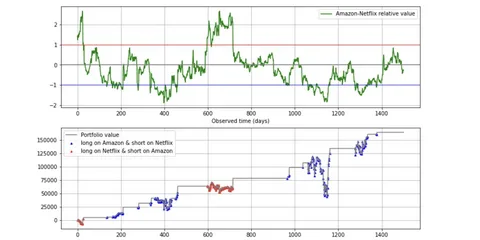

2. Spread Trading with Z-Score Strategy

One of the most popular TradingView pairs trading strategies involves using statistical measures like Z-score.

Steps:

- Calculate the price spread between two assets.

- Determine the mean and standard deviation.

- Enter trades when the spread moves 2 standard deviations away from the mean.

- Exit when it reverts to the average.

Many traders use custom Pine Script indicators on TradingView to automate Z-score calculations and visualize entry zones clearly.

3. Cointegration-Based Strategy

Correlation alone is not enough. Professional traders prefer cointegration because it ensures a stable long-term relationship between two assets.

If two assets are cointegrated:

- Their spread remains mean-reverting over time.

- Temporary divergences create reliable opportunities.

While cointegration testing is more statistical, traders can use TradingView to monitor spread stability and apply technical confirmations like RSI or moving averages.

4. RSI Confirmation Strategy

Combining RSI with pairs trading improves timing.

Strategy approach:

- Identify a divergence in the pair.

- Confirm the overbought asset with RSI above 70.

- Confirm the oversold asset with RSI below 30.

- Enter opposite positions accordingly.

This reduces false signals and improves entry precision.

5. Moving Average Crossover on Spread

Instead of applying indicators to individual charts, advanced traders apply them to the spread chart.

Example:

- Create a spread between Asset A and Asset B.

- Apply a short-term and long-term moving average.

- Enter trades when a crossover confirms mean reversion.

This approach blends statistical and technical analysis into one structured system.

Risk Management Rules

Even the best TradingView pairs trading strategies can fail without proper risk control.

Professional traders:

- Risk only 1–2% of capital per trade

- Use stop-loss levels based on spread deviation

- Avoid over-leveraging

- Monitor correlation stability

Pairs trading reduces directional risk — but it does not eliminate it.

Common Asset Combinations

Popular pairs include:

- Two stocks in the same industry

- Forex currency pairs with strong economic links

- ETFs tracking similar sectors

- Crypto assets with high historical correlation

Choosing the right pair is more important than the entry signal itself.

Final Thoughts

TradingView provides powerful tools that make pairs trading accessible for retail traders. From spread charting and RSI confirmation to custom Pine Script automation, traders can build highly structured strategies directly on the platform.

The key to success lies in:

- Selecting strongly correlated or cointegrated pairs

- Using statistical confirmation

- Applying disciplined risk management

- Staying consistent with execution

When applied correctly, these TradingView pairs trading strategies offer a balanced, professional approach to market-neutral trading.